The potential of open data to help businesses

business

Public intent data play a foundational role as a system of reference for the entire economy.

Public intent data add tremendous value to the economy as a whole and to various sectors. The gross value added from public data is estimated to range from 0.4 percent to 1.4 percent of GDP, according to a 2016 meta-study that focused mainly on high-income countries.1 Specific public intent data products also yield great value for particular sectors. For example, Denmark’s open access dataset of addresses generated direct economic benefits of €62 million (over DKr 450 million) between 2005 and 2009, returning the €2 million (roughly DKr 15 million) cost of investments in data many times over.2 This example is relevant for low- and middle-income countries, where the lack of addresses and address datasets have been a barrier to the development of data-driven transport and logistics services.

Creating value using public intent data

Entrepreneurs create value using public intent data in ways similar to how they use other data. First, companies use public intent data to improve their operations. US retailers, for example, combine data from the American Community Survey with their own sales data to customize inventory regionally.3 On the operations side, businesses rely on price-level data to set wages and allowances, among many other uses.4 Second, firms use public intent data to develop new products or services, including research and analytics services.5 For example, the global energy analytics sector depends on data from the Energy Information Administration to monitor worldwide patterns of energy use.6 Other businesses use data to provide new forms of advice to their customers. Farmerline, a company in Ghana, combines government meteorological and administrative data with proprietary data to provide advice to farmers via text message. Firms also rely on demographic statistics and business registers to inform their decisions about whether and how to enter new markets. Finally, firms may act as data intermediaries (see chapter 8), aggregating and repackaging government data in more accessible, user-friendly formats.

The changing landscape of business sectors driven by public data

While businesses driven by public data have been studied in high-income economies in some detail,7 there is little systematic information on private sector use of public intent data and their value to the economy in lower-income countries. Nevertheless, a handful of sources shed light on the business use of public intent data, including in emerging economies.8

These sources indicate that companies using public intent data span a wide range of sectors in both high-income and low- and middle-income economies. Around the world, the technology sector clearly dominates. In low- and middle-income economies, the research and consulting sector is the second most frequent user of public intent data. Companies using such data tend to be young and small in terms of the number of employees, with a large majority of global companies that use GovLab’s OpenData500 Global Network database having 200 or fewer employees. In terms of the data used, half of the US-based OpenData500 companies use data from multiple government agencies. The US Census Bureau is one of the most used sources (16 percent). Similarly, in Mexico, the national statistics office, the National Institute of Statistics and Geography (INEGI), is the most important source of public intent data for businesses, with 88 percent of companies reporting that they use INEGI data. Among the 200 firms in low- and middle-income countries included in the Open Data Impact Map compiled by the Open Data for Development Network, geospatial data are the most commonly used type of public intent data (41 percent), followed by demographic data (36 percent), economic data (30 percent), and health data (27 percent).

These assessments indicate that the business sector that uses public data is much smaller in most low- and middle-income countries than in high-income economies. This pattern is related closely to challenges with public intent data in general.9 In many cases, national data systems are limited with respect to the amount of data being produced as well as their quality and usability, timeliness, openness, and accessibility (see chapter 2).10 Indeed, companies driven by open data surveyed by the World Bank reported poor quality and lack of openness of and accessibility to public intent data as major concerns.11 The more active public data–driven business sec-tors in Mexico and other Latin American countries illustrate the potential for low- and middle-income countries. Realizing this potential requires better financing mechanisms and high-capacity, integrated, and open national data systems (see chapter 9).

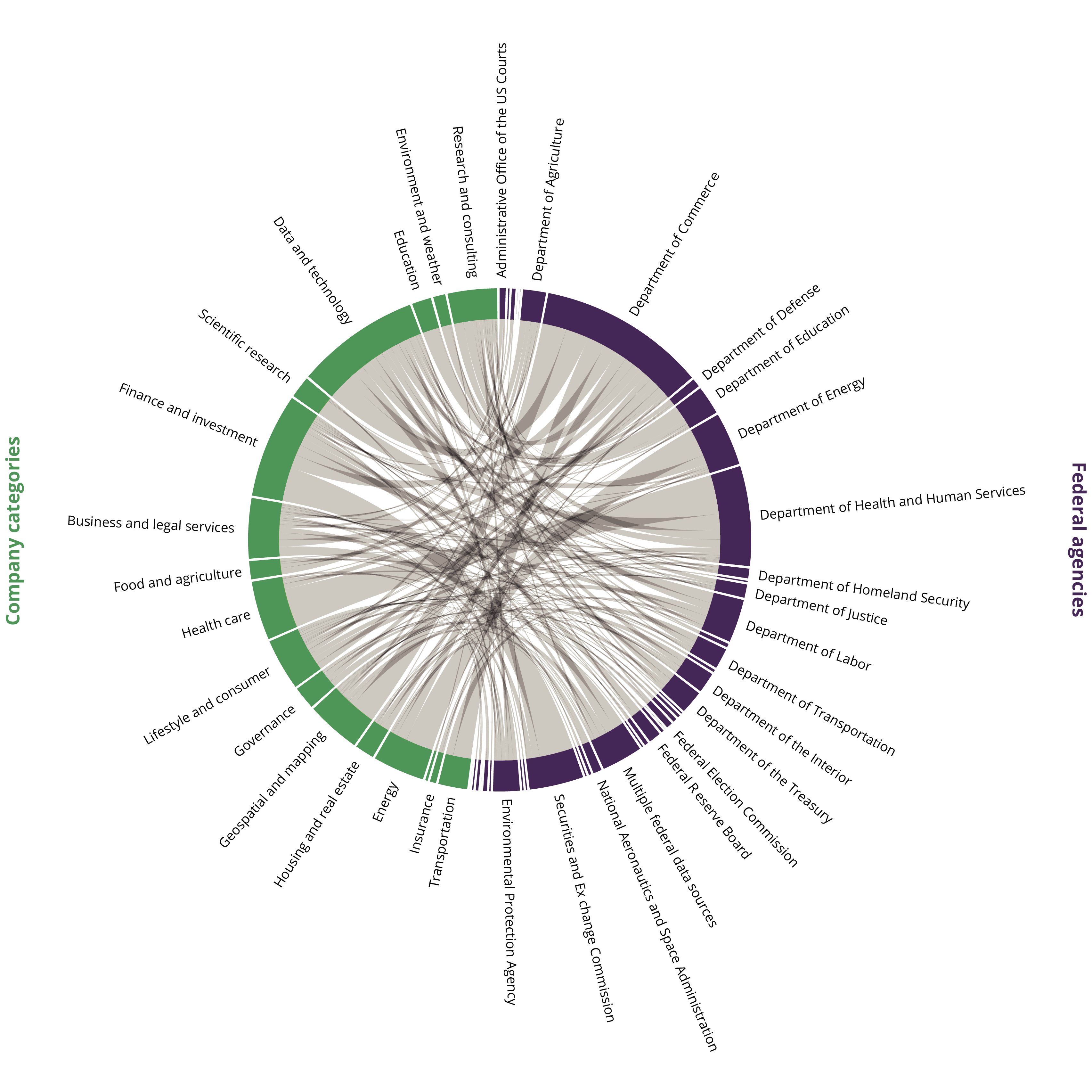

Source: Verhulst and Caplan 2015. Figure S3.1.1 data available at World Bank Data Catalog.© The GovLab. Used with permission of The GovLab; further permission required for reuse.

Note: The figure centers on 500 US firms. Starting with the right-hand, purple-shaded half of the circle, the gray lines emanating from the federal agencies show which type of private sector firms have used data from which government departments. The portion of the semicircle for each department reflects the number of firms using its data. Moving to the left-hand, green-shaded half of the circle, the gray lines emanating from the private sector reveal which categories of company have used data from which government agency. For example, firms in the finance and investment sector have used open data from 19 US departments and agencies.

Figure S3.1.1 visualizes the huge potential of open data. The figure centers on 500 firms based in the United States. It reveals widespread private sector use of publicly available federal government data, though data from some agencies are used more than from others. For example, fewer firms use open data from the Department of Agriculture than from the Department of Commerce (home of the US Census and many other important data), as evidenced by a smaller portion of the circle allocated to the Department of Agriculture. But, even in the case of agriculture, firms from seven distinct sectors have used the Department of Agriculture’s open data. Figure S3.1.1 also reveals that companies from some sectors rely on many types of government data. For example, firms in the finance and investment sector have used open data from 19 US departments and agencies. The intricacies of the connections reveal the great potential for data use, reuse, and repurposing. Such uses have only begun to be exploited in both higher-income and lower-income countries.

- Lateral Economics (2014).

- McMurren,Verhulst, and Young (2016).

- Hughes-Cromwick and Coronado (2019).

- Hughes-CromwickandCoronado (2019).

- Gurin, Bonina, and Verhulst (2019); Magalhaes and Roseira (2017).

- Hughes-Cromwick and Coronado (2019).

- See, for example, Hughes-Cromwick and Coronado (2019); Lateral Economics (2014); Manyika et al. (2013); and Stott (2014).

- See Morrison and Lal Das (2014); Open Data Impact Map (database), Center for Open Data Enterprise.

- Gurin, Bonina, and Verhulst (2019).

- Gurin, Bonina, and Verhulst (2019).

- Morrison and Lal Das (2014).

- Gurin, Joel, Carla Bonina, and Stefaan Verhulst. 2019. “Open Data Stakeholders: Private Sector.” In

The State of Open Data: Histories and Horizons, edited by Tim Davies, Stephen B. Walker, Mor Rubinstein, and Fernando Perini, 418–29. Cape Town, South Africa: African Minds; Ottawa: International Development Research Centre. - Hughes-Cromwick, Ellen, and Julia Coronado. 2019. “The Value of US Government Data to US Business Decisions.” Journal of Economic Perspectives 33 (1): 131–46.

- Lateral Economics. 2014. “Open for Business: How Open Data Can Help Achieve the G20 Growth Target.” Omidyar Network, Redwood City, CA.

- Magalhaes, Gustavo, and Catarina Roseira. 2017. “Open Government Data and the Private Sector: An Empirical View on Business Models and Value Creation.” Government Information Quarterly 37 (3): 101248.

- Manyika, James, Michael Chui, Peter Groves, Diana Farrell, Steve Van Kuiken, and Elizabeth Almasi Doshi. 2013. Open Data: Unlocking Innovation and Performance with Liquid Information. New York: McKinsey Global Institute.

- McMurren, Juliet, Stefaan Verhulst, and Andrew Young. 2016. “Denmark’s Open Address Data Set: Consolidating and Freeing-Up Address Data.” Governance Lab, New York University, New York; Omidyar Network, Redwood City, CA.

- Morrison, Alla, and Prasanna Lal Das. 2014. “New Surveys Reveal Dynamism, Challenges of Open Data-Driven Businesses in Developing Countries.” Data Blog (blog), December 15, 2014.

- Stott, Andrew. 2014. “Open Data for Economic Growth.” Working Paper 89606, World Bank, Washington, DC.

- Verhulst, Stefaan, and Robyn Caplan. 2015. “Open Data: A Twenty-First-Century Asset for Small and Medium-Sized Enterprises.” The GovLab, New York University, New York.