Using data to manage debt during the COVID-19 pandemic

debt

Improvements in data and data collection, reporting, and monitoring about debt will be critical to borrowers and creditors alike.

Data on public debt remain opaque in some countries, potentially enabling governments to overborrow and hide debts from their citizens and creditors, at least for some period (see the example of Mozambique from chapter 1). This vulnerability is compounded by the high (reported) debt levels of lower-income countries at the outset of the COVID-19 crisis and the changing composition of private creditors and debt instruments. In 2019 almost half of all low-income countries were either in debt distress or at high risk of it. As the pandemic pushes as many as 150 million people into extreme poverty,1 countries may need to take on substantial additional debt, which could result in large debt overhangs that could take years to manage.

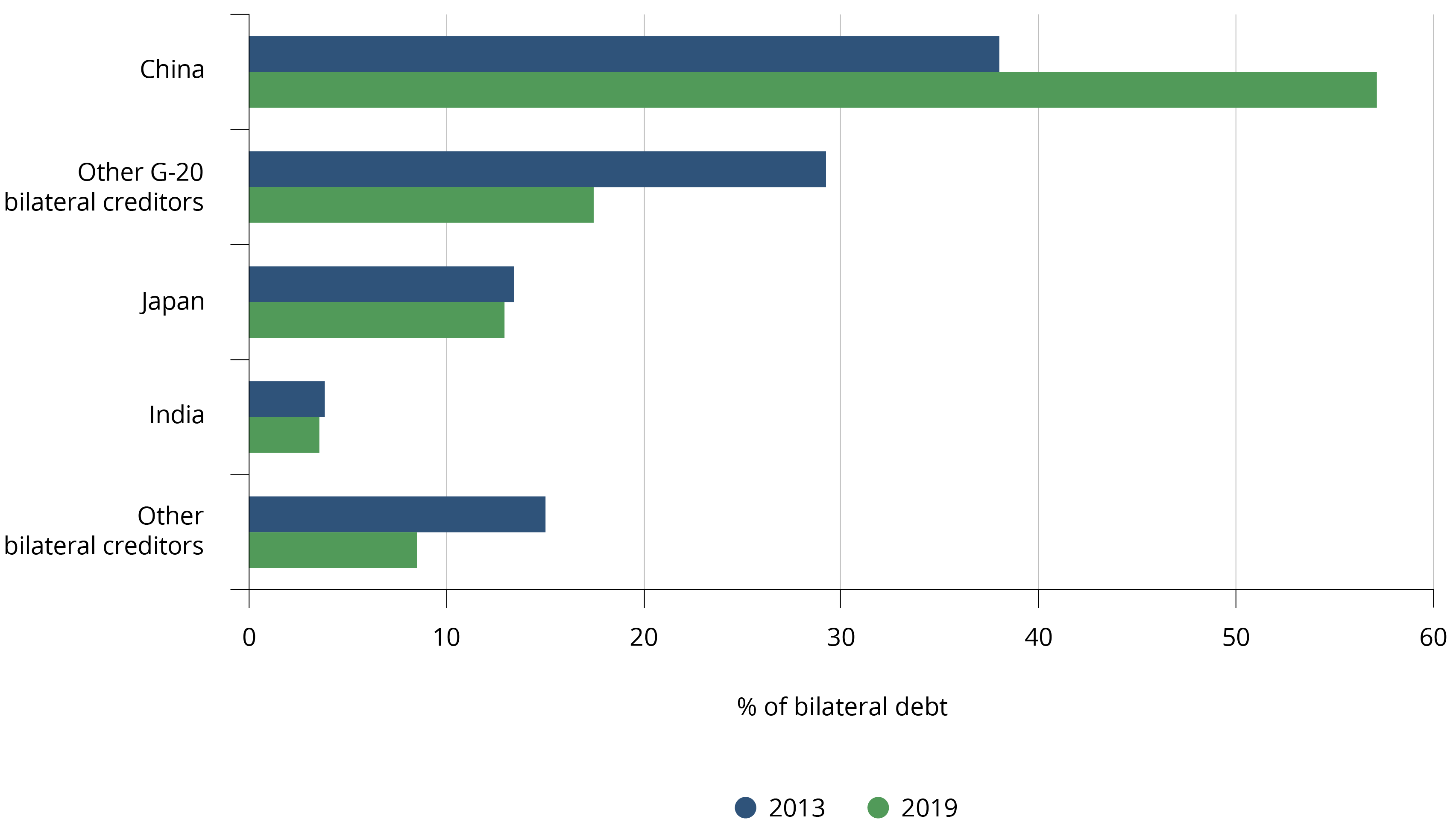

The proliferation of complex debt instruments may make it easier for governments to obscure their debt position. Moreover, the composition of creditors is changing: China, the largest creditor, increased its share of the combined debt owed by Debt Service Suspension Initiative (DSSI)-eligible countries to G-20 countries from 38 percent to 57 percent between 2013 and end-2019 (figure S1.2.1). These changes could create new exposures, especially regarding access to future debt. While most lower-income countries owe a relatively small share of their external public debt to private creditors, some countries, including Chad, Côte d’Ivoire, Ghana, Saint Lucia, and Zambia, owe as much as 50–60 percent to private creditors. Private sector participation in achieving a sustainable debt trajectory will become increasingly critical for many countries.

DSSI-eligible countries’ bilateral debt: Composition of creditors, 2013 and 2019

Source: Debt Data (dashboard), World Bank, Washington, DC. Figure S1.2.1 data available at World Bank Data Catalog.

Note: For more information, see “What Is the External Debt Reporting System (DRS)?” World Bank, Washington, DC. DSSI = Debt Service Suspension Initiative.

Recognizing the pressing need to manage the debt burden of low-income countries, the World Bank and International Monetary Fund (IMF) have proposed the DSSI.2 In managing current and future debt, governments and partners will need to improve the coverage, quality, timeliness, granularity, and transparency of debt data.3 This effort requires investing in both the data themselves and in the systems for collecting, managing, analyzing, and reporting data, especially for countries where the risks are greatest. The World Bank and IMF have offered the following recommendations to the G-20:4

- Establish clear and internationally harmonized concepts and definitions of debt. Governments should adopt international reporting and statistical standards that clearly define debt concepts. New standards should be developed where gaps exist to improve the granularity of debt data.

- Strengthen legal frameworks within countries. Stronger legal frameworks have clearly defined organizational structures, roles, and responsibilities; sufficient monitoring, auditing, and compliance mechanisms in place to avoid conflicts of interest; internal controls to make sure that laws, procedures, and policies are followed; and well-coordinated debt management and other fiscal policies and financial frameworks.

- Build a functional debt recording, management, and dissemination system. A robust system is needed to facilitate the production and use of timely, accurate, high-quality, reliable, and complete data. The system should be interoperable with other key applications and be protected by appropriate security and data protection controls. Disseminating debt data openly in user-friendly formats and building the capability of systems to produce reports for borrowers and inform debt service transactions can facilitate the use of data.

- Improve the organizational structure. High-level government commitment and clear mandates are essential.5 Effective coordination and accountability mechanisms can help to disentangle fragmented debt management functions across institutions and entities and ensure the timely sharing of data and analysis. Debt management offices should have the authority to collect data from state-owned enterprises or other indebted public entities.

- Strengthen staff capacity. Highly skilled staff with technical capacity to extract, analyze, and publish debt data are needed and should be retained and adequately compensated.

Multilateral institutions such as the World Bank and IMF play a critical role in improving debt transparency by improving coverage in the databases they manage, providing technical assistance, performing assessments on a country’s current debt management framework, designing international standards on debt, and building awareness. Lenders, along with borrowers, also have a responsibility to report debt information fully, accurately, and transparently.

All of these steps will help creditors to assess accurately the debt sustainability of their potential borrowers, citizens to hold their governments accountable for the debt they assume, and borrowers to design strategies based on a clear understanding of the level, cost, and risk profile of their debt portfolio. Increased debt transparency will also help many low- and middle-income countries to assess and manage their external debt during and after the COVID-19 crisis and to work with policy makers toward achieving sustainable debt levels and terms.

- World Bank (2020b).

- World Bank (2020a).

- IMF and World Bank (2018).

- World Bank (2020a).

- Teeling (2018).

- IMF (International Monetary Fund) and World Bank. 2018. “G20 Notes on Strengthening Public Debt Transparency.” IMF, Washington, DC, June 14, 2018.

- Teeling, Gerry. 2018. “Debt Data Transparency.” Background paper for Intergovernmental Group of Experts on Financing for Development, 2nd Session, United Nations Conference on Trade and Development, Geneva, November 7–9, 2018.

- World Bank. 2020a. “Debt Service Suspension and COVID-19.” Factsheet, December 21, 2020, World Bank, Washington, DC.

- World Bank. 2020b. Poverty and Shared Prosperity 2020: Reversals of Fortune. Washington, DC: World Bank.